Municipal risk managers have significant responsibilities. Resident complaints, employee incidents, and a continuous stream of claims are just some of the challenges that are compounded by an inefficient system and the need to juggle priorities. Claims and risk automation allows the public sector to streamline their processes and achieve numerous benefits.

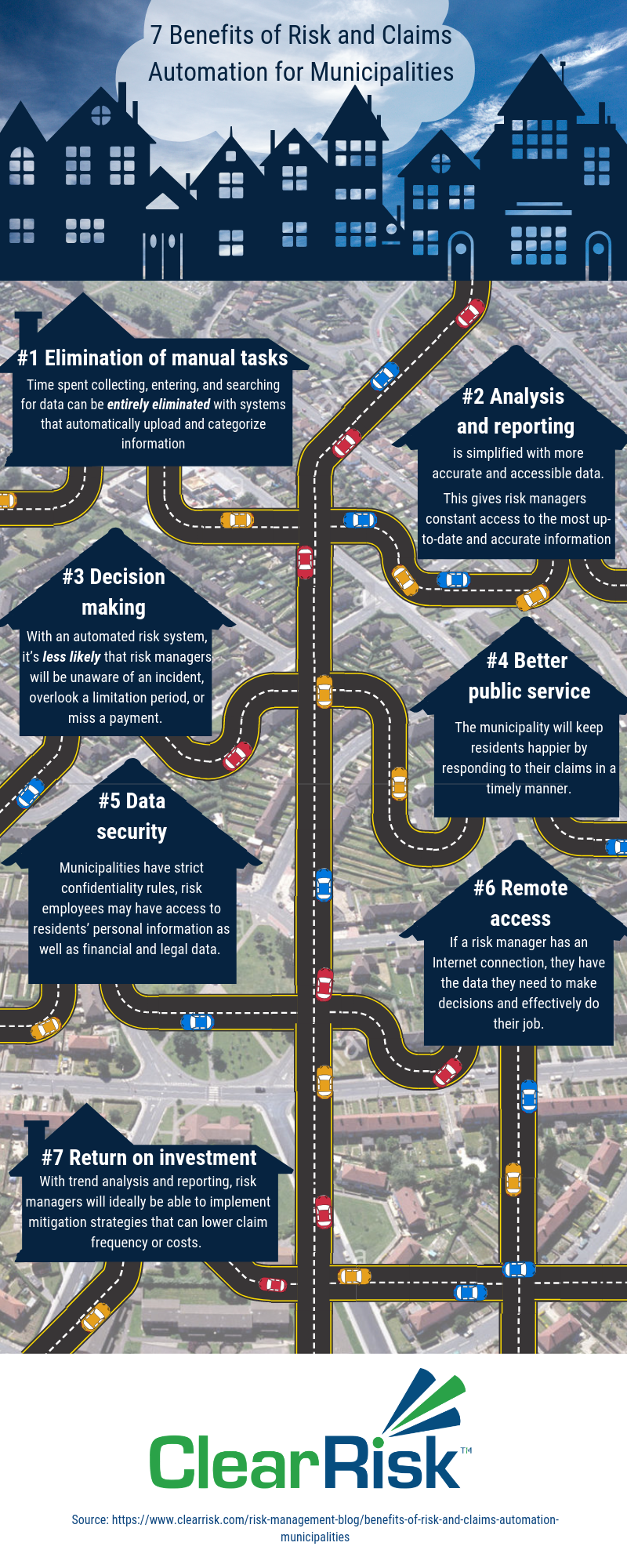

7 Benefits of Risk and Claims Automation for Municipalities

1. Elimination of manual tasks

A municipality of 50,000 people can experience hundreds, if not thousands, of claims and incidents in a single year — a number that only increases with population size. Managing the data associated with these events is a daunting task. It’s also a task that is not necessary with today’s technology. The time spent collecting, entering, organizing, and searching for data can be entirely eliminated with systems that automatically upload and categorize information. Here’s an example of an automated process:

- As soon as an incident occurs, an employee (or the claimant) inputs relevant details, such as the claimant name, incident information, and any supporting documentation. This data is recorded on an online data submission form, accessed from any device with an Internet connection.

- Instantly, the risk manager and/or claims department is sent a notification saying that a new claim has been created in the system. They can then view the details and take action. Depending on your desired workflow, claims of a certain type can also be sent automatically to your adjuster or TPA.

- Alternatively, if a risk manager needs to refer back to a previous incident, they can search by any category to instantly access claim details, payment information, and supporting documents.

This process eliminates time-consuming manual data entry. With the elimination of this task, risk managers are able to direct attention to more valuable activities, such as risk prevention and mitigation — the true goal of professionals in the industry. Further, there is a lower error frequency and data is uploaded instantly.

2. Analysis and reporting

Analysis and reporting are simplified with more accurate and accessible data.

Many types of analysis can be useful to municipal risk managers. First and foremost is trend analysis. Claims and incident trend analysis is particularly valuable as incidents are the number one predictor of future claims. Trends identify problem areas or processes and illuminate their root cause, allowing risk managers to fix a problem at its source.

For example, if a municipal risk manager is notified by the system that there is an increased frequency of sewer backup claims in one area of the city, this is an indication of an issue that needs to be addressed. By recognizing the specific problem, the risk manager can work with the water and sewer department to find a solution that will reduce claims frequency and severity.

Municipalities may also consider comparison analysis to determine how their claim frequency and costs measure up to a previous period or a municipality of a similar size. Another option is loss-cause analysis, to dig deeper into risk-related changes over time and what may have caused them.

Risk automation simplifies analysis as data is continuously collected and organized and risk managers have constant access to the most up-to-date and accurate information. This enables them to report on the details that matter most and visually represent the meaningful impact of the risk department. Instead of compiling data from multiple sources, it is organized at the press of a button.

3. Decision making

When executives have access to better reports, they can be confident they’re using the best possible data and make more effective decisions. In risk-related situations, time is often essential. This confidence allows the municipality to remain adaptable and respond appropriately to even the most complex or novel situations.

Decision making is also aided by communication. With an automated risk system, it’s less likely that risk managers will be unaware of an incident, overlook a limitation period, or miss a payment. They can set up reminders and notifications that will be sent directly to the inbox of relevant parties. If necessary, they can deliver reports and statistics on the fly since all data is at their fingertips.

Better data and data insights can help risk managers get buy-in from other departments and senior management on needed risk management initiatives and the budgets required to finance them. When claim and incident causes and costs are clearly quantified, and trends are apparent, illustrating the ROI of a risk management initiative is much easier.

4. Better public service

All the benefits described above allow risk employees to handle claims more quickly and effectively. The result: better public service and reputation. The municipality will keep residents happier by responding to their claims in a timely manner while attracting and maintaining excellent employees with their reputation for providing meaningful work.

5. Data security

Municipalities have strict confidentiality rules, and for good reason: risk employees may have access to residents’ personal information as well as financial and legal data. It’s imperative that these are stored securely.

Many municipalities turn to external vendors for automated systems, which places their data in good hands. These vendors have the resources to invest in high-level security systems and updates.

These systems can also assign various levels of access: for example, some employees may access data as view-only while managers are able to edit or delete it. Finally, risk managers can track any changes that are made to a data set and share information securely.

6. Remote access

Occasionally, municipal employees may be sick, need to work from home, or be on-site. It’s challenging to keep track of these interactions if a risk system is only accessible from an employee’s desk.

Some automated systems can be securely accessed from any smart device. If a risk manager has an Internet connection, they have the data they need to make decisions and effectively do their job.

7. Return on investment

Many organizations, especially traditional ones, may be hesitant to make the significant upfront investment that comes with an automated system. However, the return is more than worth it.

With trend analysis and reporting, risk managers will ideally be able to implement mitigation strategies that can lower claim frequency or costs. These savings, as well as eliminating manual employee tasks, easily cover the amount of the investment.

In addition, demonstrating that there is a formalized risk management plan in place and that claim frequency is decreasing can help a municipality negotiate better insurance premiums.

As the technology in our professional and personal lives evolves, residents and employees of the public sector will expect their communities to change too. Any municipality that is overwhelmed with their current claims and risk process and recognizes the need for change should consider implementing an automated risk system.

ClearRisk’s Claims, Incident, and Risk Management System brings all the benefits described above and more. With more than 30 Canadian municipality clients, we’re used to adapting our product to each City’s unique needs. Want more information on what we can do for you and your community? Learn more below.

If you found this article helpful, you may be interested in:

Your comments are welcome.