The next step is to schedule a discovery session so we can understand your risk management needs in more detail.

.png)

Organization

The City of St. Albert is an Alberta municipality with a population of 65,000. The City manages approximately 100 properties and incurs 1200 minor incidents per year.

Challenges

Manual data entry and reporting, using paper files and spreadsheets, hindered the risk team’s effectiveness.

Solution

ClearRisk's Online Data Submission Web Portal with Automated Reporting Capabilities

Challenges

The City used paper files and Excel spreadsheets for their claims and incident process. This resulted in an inefficient use of employees’ time and limited their ability to work remotely.

Each time a minor incident occurred, an employee would fill out a physical form detailing the incident and email, mail, or fax it to the City office. These papers would accumulate on the insurance claim coordinator's desk until she was able to manually key each one into a spreadsheet.

This process would take around 10 minutes for each of the 1200 minor incidents. Employees would sometimes send a copy of the form both physically and electronically, meaning the insurance claims coordinator would have to check the system for an existing claim before entering one to avoid duplication of data. This 10 minutes does not consider the time that the external employee took to fill out the form and send it in.

Solution

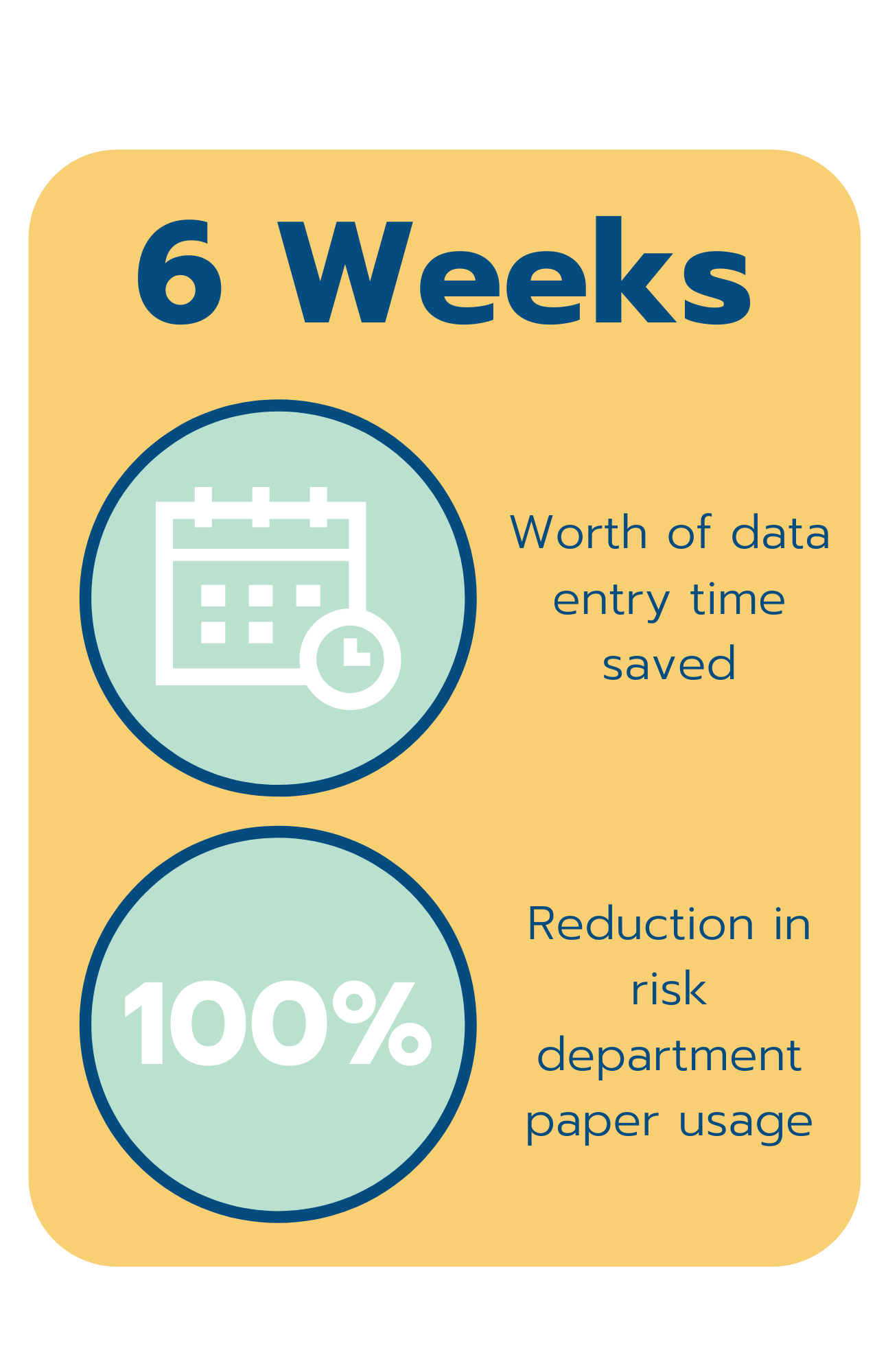

Now, with ClearRisk’s online data submission web portal, minor incidents are directly submitted into the system. An employee fills out an online web form, data is automatically populated as a claim or incident, and a notification is sent to the coordinator without any action required on her part. The result: an annual savings of almost six weeks worth of data entry work (10 minutes x 1200 incident reports = 200 hours).

There was no retraining needed, as ClearRisk customized their online data intake form to match the paper form that the City was already using. The consolidated information allows the insurance claim coordinator to send regular incident summary reports to the safety department, enabling risk prevention and mitigation.

All necessary information is now available in one system, including claims, asset records, and policy documents. Historical data was cleaned and transferred from spreadsheet records, allowing employees to quickly view and report on data in an organized way. It also enables remote access, giving employees the ability to work from home when necessary.

Results

- 6 weeks of data entry time saved annually

- The risk department has gone paperless

- Consolidated and remotely accessible data

- Consistent, effective risk management

Request a demo

.png)

ClearRisk 2020. This case study constitutes proprietary information of ClearRisk. No part of this case study may be reproduced, transmitted, transcribed stored in a retrieval system or translated into any language in any form without the written permission of ClearRisk. ClearRisk reserves the right to make changes in this case study at any time and without notice. ClearRisk makes no warranties, expressed or implied in this case study. The topics discussed in this case study are broad in scope and situations can differ greatly in legal jurisdictions, different industries, and different companies.

.png?width=1050&height=450&name=email%20signature%20(4).png)