The next step is to schedule a discovery session so we can understand your risk management needs in more detail.

Company

With annual sales of more than $12 billion, METRO INC. is a leader in the food and pharmaceutical distribution in Québec and Ontario, where it operates a network of more than 600 food stores under several banners and processes approximately 2,000 incidents per year.

Challenges

An in-house system with a tedious and ineffective incident reporting process; trend analysis limitations due to data integrity and manual report building; limited ability to share data due to heavy manual paper process.

Solution

ClearRisk's cloud-based Centralized Online Data Submission Web Portal with Automated Reporting Capabilities.

Challenges

Metro Inc. is the third largest food retailer in Canada. In 2016, the company had approximately 2,000 incidents reported. Store managers reported incidents via phone, fax or mail. The risk staff was then tasked with manually entering the information into their system and creating a paper file of the incident. Attachments would be stored in a file folder or on a shared drive in individual folders. Often times, they were required to follow-up with the store manager to complete missing information.

The process was tedious and resulted in considerable time delays as well as the risk of misplacing files. Reports required hours to create and only contained basic information due to the limited capabilities of the in-house system. Accountability for individual stores was impossible because it wasn’t feasible to create reports for each location.

Solution

With the new solution launched, store managers have the ability to click on an internal link from any Internet-enabled device to access the incident form. The customized fields and drop-down options ensure all information is inputted accurately and all relevant data is collected. Once the incident form is submitted, all data is automatically uploaded into the system and relevant risk personnel are notified based on information provided. A process that would have previously involved multiple phone calls, emails, spreadsheet tracking, and staff is now completed directly by the store manager – and within minutes. A report that used to take 3-4 hours to build can now be done within minutes.

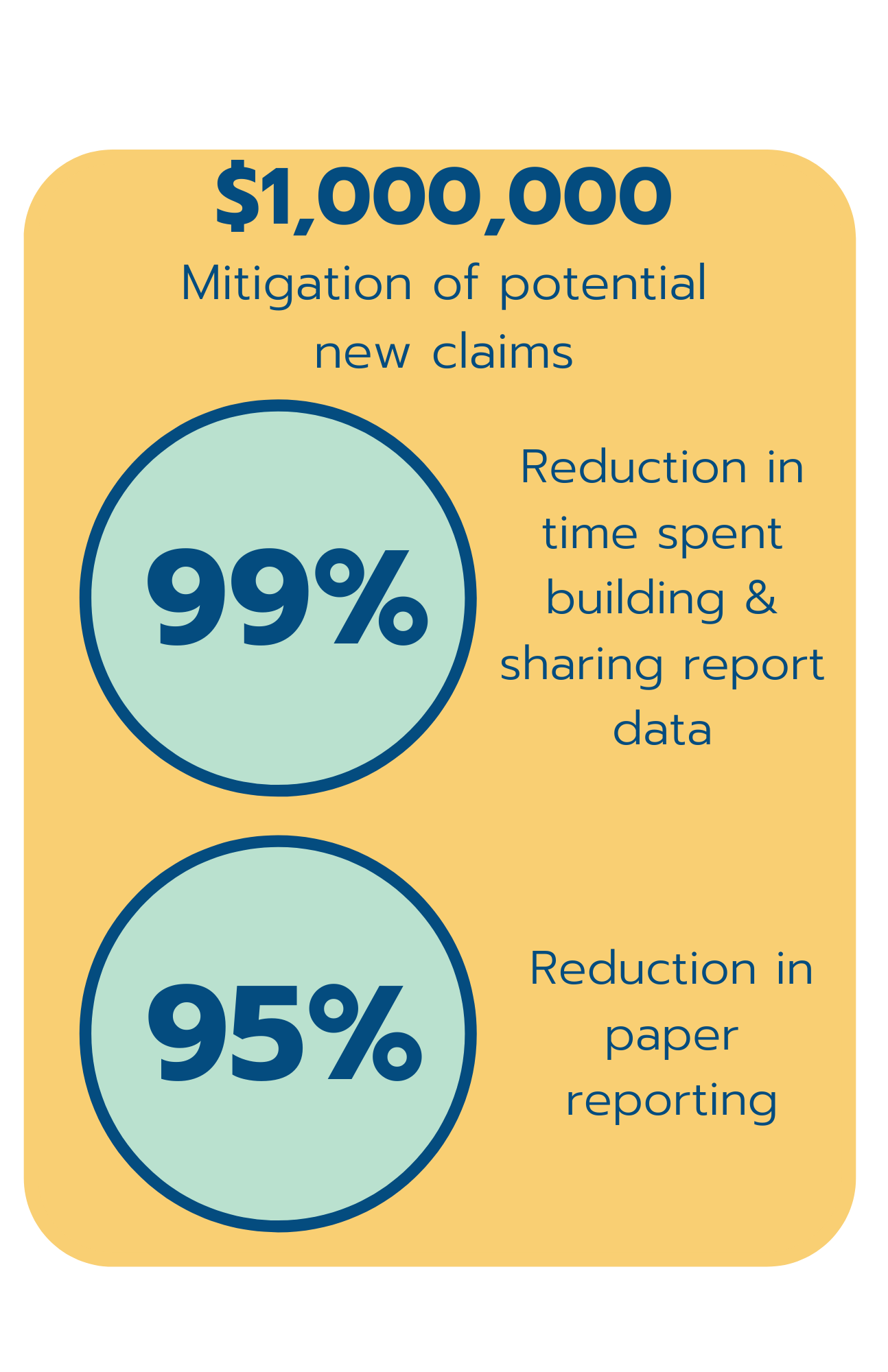

The time saved on manual report building by the risk manager is now reallocated to trend analysis. For example, this analysis uncovered less than expected quality floor mat contributing to a significantly increased frequency within a period. By quickly identifying the risk trend and main peril, floor mat performance was corrected, leading to a mitigation in potential new claims by more than $1,000,000.

Joanne Penney, Risk Manager for Metro, says, “Being able to quickly review relevant data to analyze and share necessary information between departments allows for timely, informed decision-making. Accountability for individual locations is now possible because of the ClearRisk platform and now we get to focus more time implementing strategies that create a safer, efficient organization.”

Results

- Substantial annual reserve projection savings from slip, trip, and fall claims.

- Online web portal eliminates manual data entry and increases data integrity

- 99% reduction in time spent building and sharing report data

- Robust reporting capabilities allow for in-depth trend analysis

- Risk management culture created when locations held accountable for losses

- 95% reduction in paper reporting

Request a demo

.png)

ClearRisk 2020. This case study constitutes proprietary information of ClearRisk. No part of this case study may be reproduced, transmitted, transcribed stored in a retrieval system or translated into any language in any form without the written permission of ClearRisk. ClearRisk reserves the right to make changes in this case study at any time and without notice. ClearRisk makes no warranties, expressed or implied in this case study. The topics discussed in this case study are broad in scope and situations can differ greatly in legal jurisdictions, different industries, and different companies.

.png?width=1050&height=450&name=email%20signature%20(4).png)