The next step is to schedule a discovery session so we can understand your risk management needs in more detail.

.png)

Company

The Town of Ocean City is a resort town on the Atlantic coast in the State of Maryland, which hosts up to 8,000,000 visitors annually. On summer weekends, they host between 320,000 to 345,000. This large influx adds a great deal of risk and complexity to the small town that boasts a full-time resident population of 7,000.

Challenges

The town decided to switch from an outdated, on-premise claims and risk management system as they desperately needed a software upgrade to better manage their growing risk and insurance program. They were also concerned of having data stored on an in-house server with risk of fire, hurricane and security vulnerabilities. They decided to seek a cloud-based solution that could automate their reporting and enhance their internal processes.

Solution

ClearRisk’s implementation team took full responsibility for the town’s data migration from the current provider. ClearRisk worked closely with the town to uncover process inefficiencies, address challenges, set milestones, and effectively steer the town through the project.

Challenges

The Town of Ocean City was using a claims and risk management system prior to implementing ClearRisk, but it was burdensome and in need of upgrades. It was not user-friendly and didn’t provide the automation, efficient workflow, or report generation necessary to meet the demands of an overloaded risk and claims management department.

The town recognized the need to switch to a new system provider. However, their current provider complicated the matter by refusing to release the town’s data without charging a fee. The town was worried about the implementation process that would ensue. Enter ClearRisk.

Solution

ClearRisk’s implementation team fully scoped the data environment and created a plan to access the town’s data directly from the current database without extraction and support fees. This plan was approved by the town, who provided ClearRisk access to clean and migrate data to ClearRisk’s system.

ClearRisk took over to perform all data migration activities while creating reports at each step of the process to ensure data accuracy and integrity. “Paul MacKinnon, our ClearRisk Implementation Manager, was amazing to work with. Paul and his team made the data much easier to read and identify, which was invaluable during the migration stage.”

With strong data in hand, the town received access to a more efficient, user-friendly system that better suited their needs and organizational structure. ClearRisk’s “outstanding” support, reporting functions, and data storage and services are meaningful changes for Christine Parks, Risk Management Associate. Christine’s role is now more organized and has expanded to have a larger impact on the town. She can better document and investigate incidents and is able to focus more time on recovering money.

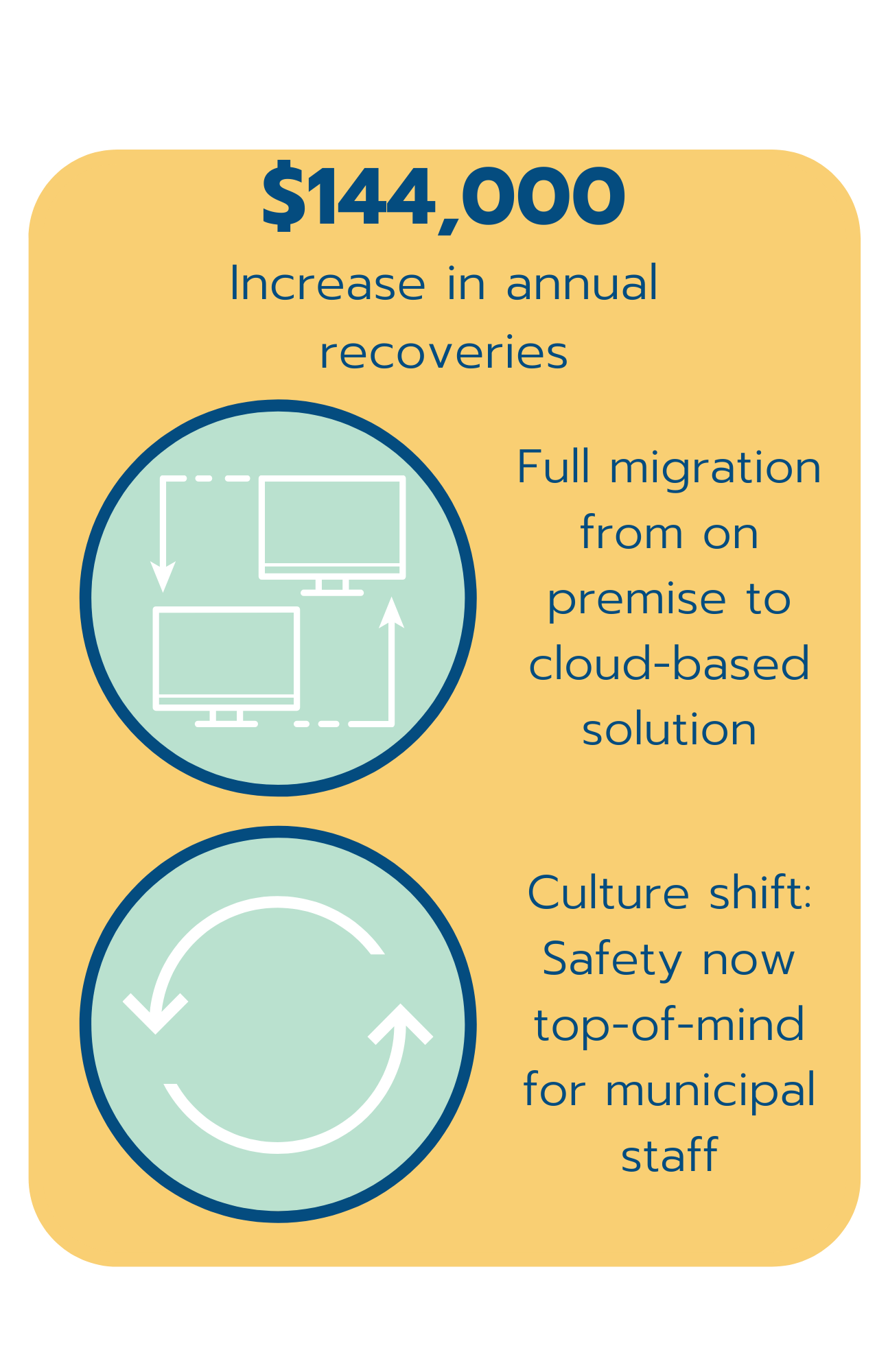

Results

- Performed full migration from outdated, on-premise system to ClearRisk’s cloudbased solution

- Safety-minded culture shift has occurred throughout entire organization

- Risk management role now creating a profit through enhanced recovery function

- Communication of data between departments has never been easier

- Creating and updating a claims and incidents takes a fraction of the time

- New system is reliable, easy to use, intuitive, and nimble

Request a demo

.png)

ClearRisk 2020. This case study constitutes proprietary information of ClearRisk. No part of this case study may be reproduced, transmitted, transcribed stored in a retrieval system or translated into any language in any form without the written permission of ClearRisk. ClearRisk reserves the right to make changes in this case study at any time and without notice. ClearRisk makes no warranties, expressed or implied in this case study. The topics discussed in this case study are broad in scope and situations can differ greatly in legal jurisdictions, different industries, and different companies.

.png?width=1050&height=450&name=email%20signature%20(4).png)