The next step is to schedule a discovery session so we can understand your risk management needs in more detail.

.png)

Company

Universal Parking of America, national leader in hospitality and management services. Manage over 100 properties and process 800+ incidents per year.

Challenges

Lengthy incident forms and submission process with limited system capability, which made incident management and reporting time-consuming and ineffective.

Solution

ClearRisk's cloud-based Centralized Database and Online Data Submission Web Portal.

Challenges

Prior to ClearRisk, managing risks was a cumbersome task. Incident reports were manual and tedious, so Universal often had difficulty collecting all the data from its site managers. Universals' Distract Manager, Justin Alcala, spent his days following up over the phone and walking employees through the claim reporting process. He then had to copy the data into multiple emails as well as his own spreadsheets. It took upwards of two hours of communication and manual entry for a single incident to be correctly documented.

Solution

When an incident occurs, the site manager logs into ClearRisk's online web portal on any smart device and inputs all relevant information. The form is simple to use and has mandatory fields so data will not be incomplete. When submitted, all information and attachments are automatically uploaded into the ClearRisk system and email notifications are sent to all relevant parties. This process takes less than 15 minutes, an 88% decrease in reporting time.

ClearRisk spoke to Justin Alcala, Area Leader and Distract Manager for Universal Parking, to gain insight into how his role has changed since implementing ClearRisk.

"My role has gone from helping site managers report a claim or incident to being able to monitor and analyze the data. The data and trend reports have been integral in creating a culture of accountability and preventative safety within our organization."

The increase in data being reported has allowed the team at Universal to identify areas in the business that were responsible for a high amount of preventable claims. The time saved by eliminating the manual data entry and creating automatic reporting allowed Justin and his team to implement mitigation strategies.

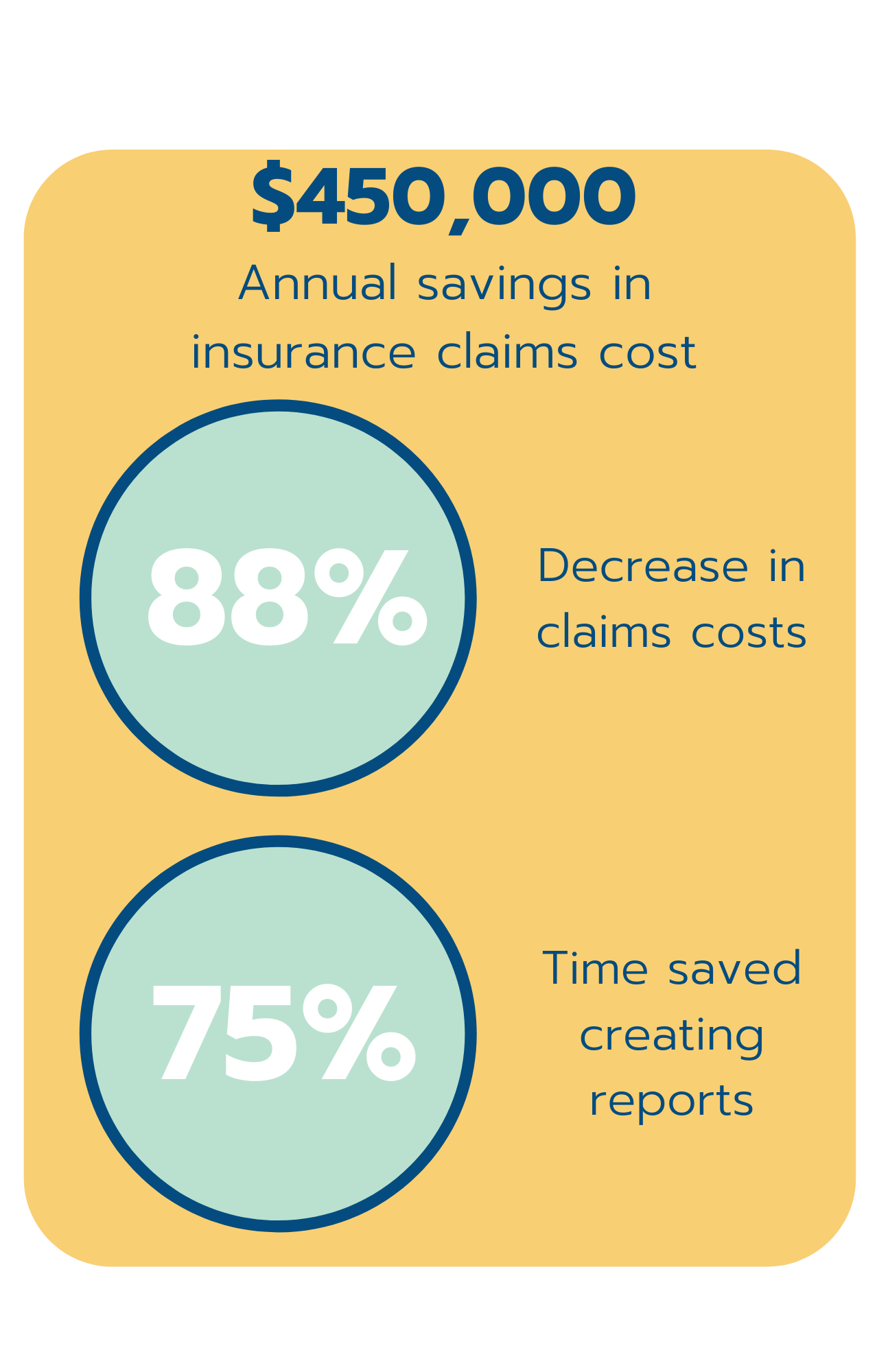

These realized efficiencies resulted in savings of over $450,000 in claims cost in 2017. ClearRisk's enhanced reporting allowed Universal to uncover claims they weren't liable for. Before ClearRisk, these costs would have gone undetected and been paid.

Results

- 88% reduction in risk management team's time collecting data and communicating corrective actions

- 75% reduction in time for a site manager to report an incident or claim

- Savings of over $450,000 in total claim cost in 2017, representing a reduction of 48% prior to implementing ClearRisk

- Saved over $50,000 in claims that they were not responsible for but previously would have paid.

Request a demo

.png)

ClearRisk 2020. This case study constitutes proprietary information of ClearRisk. No part of this case study may be reproduced, transmitted, transcribed stored in a retrieval system or translated into any language in any form without the written permission of ClearRisk. ClearRisk reserves the right to make changes in this case study at any time and without notice. ClearRisk makes no warranties, expressed or implied in this case study. The topics discussed in this case study are broad in scope and situations can differ greatly in legal jurisdictions, different industries, and different companies.

.png?width=1050&height=450&name=email%20signature%20(4).png)