Are you spending too much time performing repetitive tasks or searching for documents? Tired of limits on your ability to report to your boss, help your customers, and collaborate with your coworkers? Do you think a change could decrease your organization’s losses?

A paperless system might be exactly what you need to increase profit, reduce labour, help the environment, and change the way you manage risk from reactive to proactive. Here are just some of the advantages that going paperless with ClearRisk can bring to your organization.

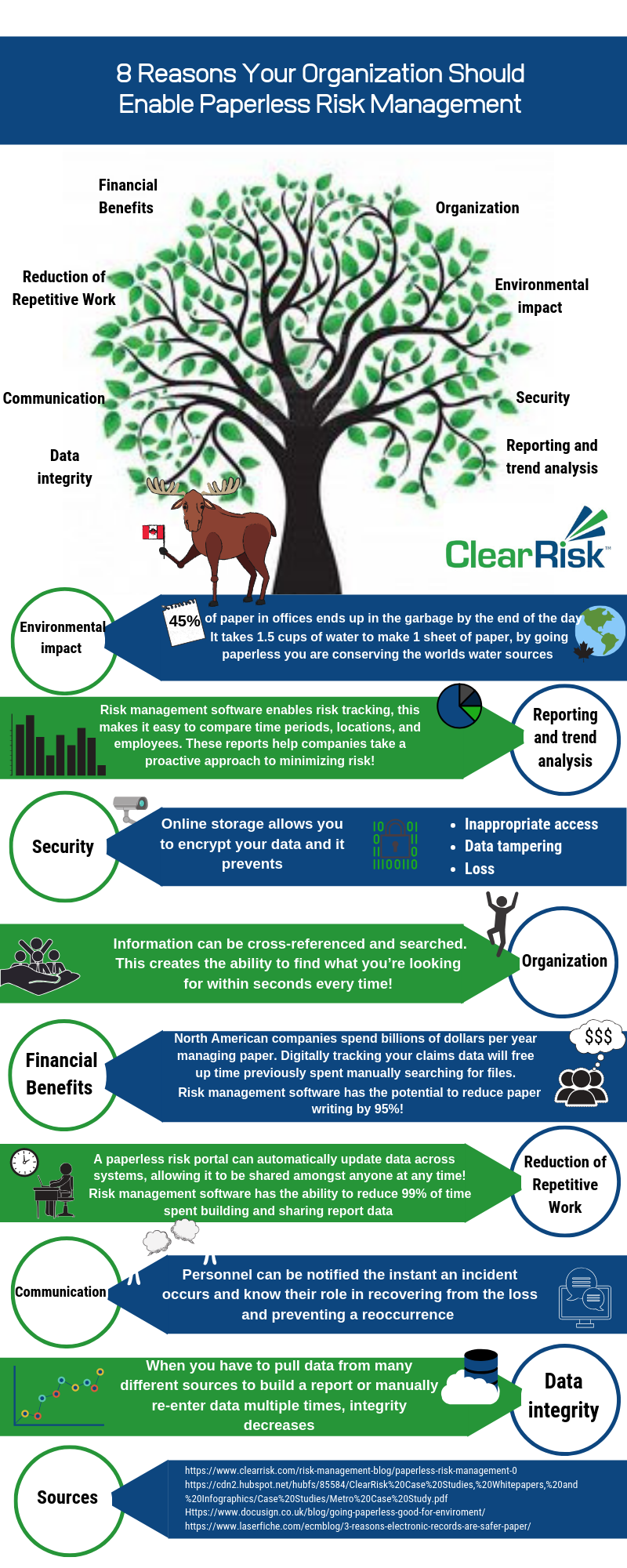

8 Reasons Your Organization Should Enable Paperless Risk Management

1. Financial benefits

Over a third of Canada’s waste is paper and paper products, and North American companies spend billions of dollars per year managing paper.

Think about it: you’re spending money on ink, paper, printers, and copiers, and the physical space to hold the documents- whether that’s a couple of filing cabinets or a couple of floors. Not to mention the cost of employees: an administrative worker could spend their day performing productive tasks, but instead they have to spend their time re-entering data and filing documents.

Digitally tracking your claims data will free up time previously spent manually searching for files.

2. Organization

Have you ever had the task of finding a particular document and dreaded searching through thousands of papers for it? Or, once you found the item, realized it was a hundred pages and you only needed to locate one small section?

With a computerized system, you’ll never face this again. Your information can be cross-referenced and searched. You’ll be able to find what you’re looking for within seconds every time! This will also allow you to group claims together, compare them, and easily find what you’re looking for to support your new risk mitigation plan.

3. Reducing repetitive work

Think about the time spent on incident reporting within your organization. When something goes wrong, who writes the report? Does it then get retyped into a file for your insurance company, rewritten to inform legal counsel, and manually entered into an excel spreadsheet that tracks claims?

Whether you are taking on risk management as a small business owner or a professional risk analyst, this redundancy doesn’t help anybody. A paperless risk portal can automatically update data across systems, allowing it to be shared amongst anyone at any time and ensuring your valuable people are performing valuable tasks

4. Reporting and trend analysis

Your supervisor asks if you have the reports ready for your meeting in half an hour: the meeting you forgot about. If you have your documents stored in paper files or in separate spreadsheets, it’s basically impossible that you’ll be able to compile the information in time. However, by storing data online in a program that automatically runs analytics, you’ll always be prepared.

For risk tracking, this will make it easy to compare time periods, locations, employees - you name it. To find out where your mitigation procedures aren’t working, software will track your claim history, allowing you to understand what actions can be put in place to stop further repetitive (and possible preventable) losses.

5. Communication

The world is constantly becoming more computer-based. Customers expect rapid, online responses to their questions and concerns, and you don’t want to be the organization that becomes infamous for long wait times or manual data errors. Storing data in an easily accessed format will not only make your clients happy, it will benefit all your employees.

No longer will instructions get lost in email chains or a report be misunderstood. With risk management software, personnel can be notified the instant an incident occurs and know their role in recovering from the loss and preventing the same type of damage in the future.

6. Security

You may be worried about the safety of your documents and confidential information, but ask yourself: how effective are those filing cabinet locks? Online storage allows you to encrypt your data so that no one can access it without permission, and makes it difficult for an important document to be lost or incorrectly filed. You can also have multiple backups, so that if anything happens to your physical office, the data that keeps your organization alive will be secure.

7. Data integrity

When you have to pull data from many different sources to build a report or manually re-enter data multiple times, integrity decreases. It’s very possible that someone will make a mistake along the way. Digital risk management systems have drop-down menu options to eliminate data integrity issues.

8. Environmental impact

This one may be obvious, but it’s worth mentioning. North America uses approximately 68 million trees a year; the average American goes through 700 pounds of paper annually. And 45% of paper in offices ends up in the garbage by the end of the day. These numbers are out of control, and even a small business can have an impact by reducing their paper usage.

Going paperless might seem a daunting task, but once you accomplish it, the financial and organizational benefits will be worth the effort. The most important stages are getting everyone on board, organizing your documents to be transferred efficiently, and obtaining support from an excellent service provider.

If you found this article helpful, you may be interested in:

.png?width=1050&height=450&name=email%20signature%20(4).png)

Your comments are welcome.